METHODOLOGY USED

Our web-based testing protocol leverages expertise, software and process allowing a novice, using the internet, to easily calculate Concentration Coefficients, Intrinsic Dimensionalities and Variance Gaps, the essentials of DIVERSIFICATION ELEMENT quantification. Your portfolio’s DIVERSIFICATION ELEMENT is then compared to the DIVERSIFICATION ELEMENT of a portfolio similar in size having an asset allocation similar to yours but prudently diversified to achieve (maximum-reasonable) reduction of UNCOMPENSATED RISK.

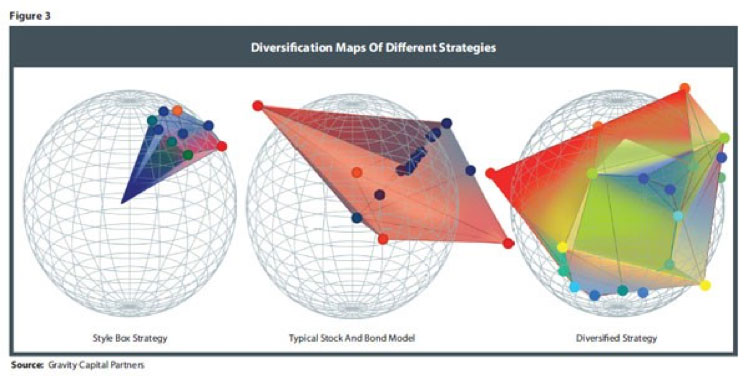

BELOW IS WHAT A PORTFOLIO MIGHT LOOK LIKE AFTER PFA’s UNCOMPENSATED RISK REDUCTION ALGORITHM IS OVERLAID WITH ADVISOR’s COMPENSATED RISK ASSET ALLOCATION

PLEASE NOTE: THIS IS AN EXAMPLE FROM SOMETIME IN THE PAST. DO NOT USE IN YOUR DECISION MAKING PROCESS

NOTE: from ASYMMETRIC to SYMMETRIC or BALANCED APPROXIMATELY 360°